Credit Card Debt

ByPeter Warden

UpdatedFeb 20, 2026

- Credit cards are unsecured revolving accounts that you can use and repay as needed.

- Credit card debt results when you carry balances from month to month.

- Making only the minimum payment can trap you in credit card debt for years.

Table of Contents

What Is Credit Card Debt?

Credit card debt is money that you owe to the credit card companies and banks that issue credit cards. Sorry for the jargon, but credit cards are “unsecured, revolving accounts.” If you’re unfamiliar with those terms, they’re easy to understand:

An unsecured debt does not require you to pledge an asset as collateral, aka security. The most common sorts of secured debts are mortgages and auto loans. If you default, your lender can foreclose on your home or repossess your car. But, with unsecured debt, lenders have no direct route to seizing any of your property.

Revolving accounts are nearly all store and credit cards. And, as you know, you revolve your credit: borrow, repay, borrow, repay, round and round in circles. You just have to keep within your credit limit and make at least the minimum payments.

You may not have known the terms, but you already understood the concepts. When you charge an amount on your credit card, you increase the balance owed to your credit card issuer. When you make a payment, you reduce that balance. If you don’t pay the entire balance each month, the amount that you carry (and pay interest on) becomes credit card debt.

Who Carries Credit Card Debt?

In May 2022, the Board of Governors of the Federal Reserve System published its annual review of personal finances, the Economic Well-Being of U.S. Households in 2021. And it tells you quite a lot about who carries credit card debt. Here are some key findings:

In 2021, 84% of American adults had one or more credit cards

Roughly half of all households zeroed their card balances every month

The other half carried a balance forward once or more in 2021

At the time of the survey, 73% of those in the second group carried a balance

You might think that 73% figure implies many carry balances forward every month

“Middle-income adults were the most likely to have a credit card that they used to finance purchases by carrying balances from one month to the next”

The survey dug deeper into the sorts of people who carry credit cards and credit card debt.

Education

There was a strong correlation between people’s level of education and their use of plastic:

76% of high school graduates had cards of whom 57% carried balances forward sometimes or always

96% of those with bachelor degrees or higher had credit cards of whom 35% carried balances forward sometimes or always

So those with higher levels of education were more likely to have cards and more likely to zero their balances each month.

Family income

The Fed provides a table that shows how family incomes relate to credit card usage:

| Annual family income | Have a card % | Carry forward balances %* |

|---|---|---|

| Less than $25,000 | 57 | 57 |

| $25,000-$49,999 | 84 | 59 |

| $50,000-$99,999 | 94 | 50 |

| $100,000 or more | 98 | 36 |

*Once or more a year as a percentage of those in that income bracket who have credit cards.

In its report, the Fed summed up: “Middle-income adults were the most likely to have a credit card that they used to finance purchases by carrying balances from one month to the next. Almost half of people with income between $25,000 and $99,999 carried a balance on a credit card at least once in the past 12 months, exceeding the shares of adults with either lower or higher income levels who did so.”

How Much Credit Card Debt Do We Carry?

There are some concerning figures, according to Experian, one of the largest credit reporting agencies, in its 2021 Experian Consumer Credit Review.

The report concluded that U.S. consumers carried an average credit card balance of $5,221 in 2021. There are several reasons to be worried about that figure, including:

It’s the lowest it’s been for a couple of years owing to the pandemic reducing spending on things like dining out, vacations, socializing in bars, travel and in-person shopping. It was always likely to bounce back as such outgoings returned to normal

That $5,221 is an average among all consumers. COVID lockdowns split the country into two factions – those whose expenses fell while their incomes went on as before, and those whose incomes suffered or stopped. The first group was able to trim their balances and pay them down. While the second group turned to their cards to fund basic living expenses.

Many economists reckon the chances of a recession in 2022 or 2023 are high. If that translates into fewer jobs or shorter hours, some families could struggle to stay on top of their credit card debt.

Credit cards nearly always have variable rates. That means that every interest rate hike from the Federal Reserve makes card debt will get more expensive.

Real people, real problems

It’s easy for people who give financial advice to wag their fingers and sermonize about the virtues of reducing debt. But it’s often different when you’re facing difficult choices that could involve keeping food on the table, the lights on or enough gas in your tank to get to work.

Still, if you’ve any room at all to make economies in your household spending, now would be an ideal time to drive down your credit card debt. Even if you can only manage to pay a little extra.

How Minimum Payments Keep Us in Credit Card Debt

By making only the minimum monthly payment, borrowers risk falling into a credit card debt trap. That’s because most minimum payments are calculated as 1% of that month’s outstanding balance, often with a “floor amount” (minimum almost regardless of balance) of $25 or $35.

You don’t need a finance degree to work out that paying down a balance at a 1% rate would take a very long time. And all that time you’d be paying an eye-wateringly high interest rate.

Brookings did the math, assuming a $3,000 balance and an 18% APR:

"A $3,000 credit card balance with a payment floor of $35 and an 18% APR would take 11.5 years to pay off by making only minimum payments and cost $3,154 in interest."

So, you borrow $3,000 and pay back $6,154 over 138 months. And that’s a relatively kind scenario.

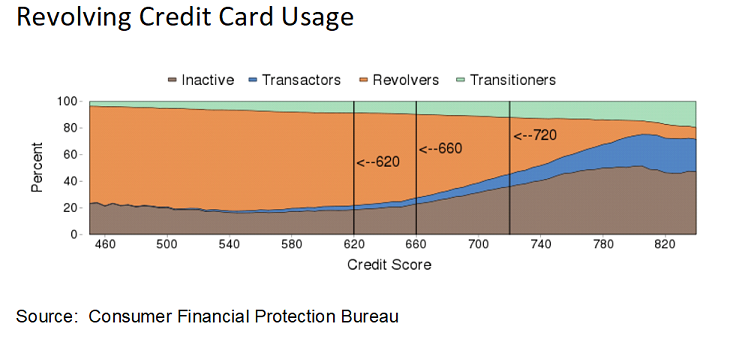

When federal regulator the Consumer Financial Protection Bureau published a report on revolving credit card usage in 2019, it found those who carry forward balances were, understandably, likely to have low credit scores. And those with low scores are nowadays unlikely to get cards with APRs as low as 18%. Many will be revolving with 20+% APRs.

The Minimum Payment Myth

It’s common to read claims that it will take decades to get out of credit card debt if you only pay the minimum. And there is truth to those statements.

But not the whole truth. The trouble with minimum payments is that they go down each month as you reduce your balance – at least until you reach your floor amount of $25 or $35. Remember, you need to pay only 1% of each month’s balance to stay current.

Credit card companies love people who just make the minimum payment every month without thinking. But if you ignore the new minimum on your statement and don’t pay less each month, you’ll pay off your balance in less than half the time and at less than half the cost.

Again, Brooking did the math:

“If a cardholder with a $3,000 balance at an APR of 18 percent made level payments equal to the initial minimum payment amount shown on her statement, it would take five years and cost $1,571 in interest.”

So you save $1,583 ($3,154 with declining minimum payments - $1,571 for constant payments) and be in debt for 78 fewer months (138 months with declining minimum payments - 60 months for constant payments). Of course, you can save even more if you take every opportunity (tax refund, bonus, windfall …) to reduce your debt faster.

Debt relief stats and trends

We looked at a sample of data from Freedom Debt Relief of people seeking a debt relief program during January 2026. The data uncovers various trends and statistics about people seeking debt help.

Credit Card Usage by Age Group

No matter your age, navigating debt can be daunting. These insights into the credit profiles of debt relief seekers shed light on common financial struggles and paths to recovery.

Here's a snapshot of credit behaviors for January 2026 by age groups among debt relief seekers:

| Age group | Number of open credit cards | Average (total) Balance | Average monthly payment |

|---|---|---|---|

| 18-25 | 3 | $8,877 | $272 |

| 26-35 | 5 | $12,187 | $375 |

| 35-50 | 6 | $16,024 | $431 |

| 51-65 | 8 | $16,739 | $524 |

| Over 65 | 8 | $17,477 | $488 |

| All | 7 | $15,142 | $424 |

Whether you're starting your financial journey or planning for retirement, these insights can empower you to make informed decisions and work towards a more secure financial future

Personal loan balances – average debt by selected states

Personal loans are one type of installment loans. Generally you borrow at a fixed rate with a fixed monthly payment.

In January 2026, 44% of the debt relief seekers had a personal loan. The average personal loan was $10,718, and the average monthly payment was $362.

Here's a quick look at the top five states by average personal loan balance.

| State | % with personal loan | Avg personal loan balance | Average personal loan original amount | Avg personal loan monthly payment |

|---|---|---|---|---|

| Massachusetts | 42% | $14,653 | $21,431 | $474 |

| Connecticut | 44% | $13,546 | $21,163 | $475 |

| New York | 37% | $13,499 | $20,464 | $447 |

| New Hampshire | 49% | $13,206 | $18,625 | $410 |

| Minnesota | 44% | $12,944 | $18,836 | $470 |

Personal loans are an important financial tool. You can use them for debt consolidation. You can also use them to make large purchases, do home improvements, or for other purposes.

Regain Financial Freedom

Seeking debt relief can be the first step toward financial freedom. Are you struggling with debt? Explore options for debt relief to regain control of your finances. It doesn't matter how old you are or what your FICO score or credit utilization is. Take the first step towards a brighter financial future today.

Show source

Author Information

Written by

Peter Warden

Peter Warden has been writing about personal finance for nearly 15 years. He’s an editor for The Mortgage Reports and a regular contributor to many major money sites. His work is often quoted or syndicated by newspapers and online.

Is credit card debt bad?

Not necessarily. Occasionally carrying forward a smallish balance to get you through a rough patch or to indulge yourself is unlikely to do much harm. But if you find yourself carrying forward balances most or every month, you should understand that as a problem. Credit card debt is expensive compared to most other forms of borrowing. Investigate your options to get rid of your credit card debt, like a DIY debt payoff plan if you have the spare income, or debt relief programs if you’re struggling.

How expensive is credit card debt?

Brookings Institute made a comparison: The interest rate charged on revolved credit card balances at the close of 2020 averaged 16.3%, compared to roughly 5% on new car loans, 7% for used car loans, and from 4.6% to 7.2% on federal student loans,

Moreover, most credit card agreements have variable interest rates, leaving consumers exposed to higher interest charges when interest rates rise, as they are currently. Depending on your credit score, you might find a personal loan with roughly half the APR you're paying on your cards.

How do I avoid the minimum payment trap?

Pay a bit more each month! And use tax rebates, bonuses and other windfalls to knock lump sums off your credit card debt.

If you take the minimum payment you made during the first billing period after your purchase and then pay that same sum consistently each month, you could halve both the interest you pay and the time you’re indebted.