Credit Score Chart and Credit Score Range

UpdatedApr 20, 2025

- Your credit score comes from your payment history, credit use, types of credit, length of credit history and new credit (inquiries).

- The most common credit scoring models are FICO and VantageScore.

- Credit score charts show credit grades and how scores are determined.

Table of Contents

Businesses make judgments about you based on your credit score all the time. So just how well do you know your credit score?

A credit score impacts you financially, but you may be surprised about how else it can affect you. Your credit score may influence things like where you live and what kind of job you can get.

Understanding your credit score can help you make sure you’re not hurt by it. This means knowing what goes into a credit score, how it can affect you, and what your credit score looks like.

This article will explain what your credit score means and summarize different levels of credit scores in a chart. Topics covered include:

What is a credit score?

Credit score chart: How is credit score determined?

Why is your credit score important?

What is a good credit score?

What is a bad credit score?

Credit score chart: from good credit to bad credit

Taking control of your credit score

Credit score FAQs

What Is a Credit Score?

A credit score is a number that indicates how likely you are to default on (not pay) loans or how likely you are to file bankruptcy. People with high credit scores are statistically much less likely to go bankrupt or default on loans than those with low credit scores.

It takes two components to create a credit score – data and a scoring model. The two main scoring models are FICO and VantageScore, and each model offers several versions. The three main sources of credit data are the big three credit reporting agencies, also called credit bureaus. They are Experian, TransUnion, and Equifax.

When a lender wants to see your credit score, it pulls your report from a credit bureau and runs that data through its chosen scoring model.

Different types of credit score

People are sometimes confused to see that they have different credit scores depending on where they look. That’s because there are many different credit scores.

First of all, there are two major organizations that calculate credit scores. A FICO Score is calculated by the Fair Isaac Corporation, an analytics company that helps businesses manage risk. This is the oldest and most widely used form of credit score.

The VantageScore is another popular scoring model. This was developed jointly by the three major credit bureaus, in an effort to standardize credit scoring across all three. Both of those models have multiple versions. And lenders don’t typically abandon their old version every time a new one comes out. A score using VantageScore 8 will probably differ from one using VantageScore 9.

Further complicating things is the fact that there are different credit scores for different purposes -- for example, whether you are applying for insurance, an auto loan, a mortgage, or a credit card.

Second, there are three credit bureaus collecting information, and they don’t necessarily have the same information. Some creditors report to all three bureaus while others report to just one or two. If Experian has a late payment in its database, but TransUnion does not, your TransUnion score is likely to be higher.

It makes sense, then, that each consumer may have many credit scores. FICO alone has 16 credit scores. VantageScore has four. If there are 20 versions of credit scoring models applied across three sets of data, that’s 60 different credit scores!

Common factors in credit scoring

Different scoring models make credit scores vary. However, what they have in common is that they consider the same factors:

Credit usage

Current balance

Available credit

Mix of credit accounts

Age of credit accounts

Payment history

Recent accounts opened

Length of credit history

The weight given to each factor may vary; that’s how models applied to the same data generate different scores.

Credit score vs. credit report

Another term you might hear besides “credit score” is “credit report.” These things are different, though they are related.

As mentioned above, credit score boils a lot of factors down into a single number. This can be thought of as a summary of how safe you are considered to be with credit.

A credit report doesn’t include a summary number. Instead, it offers a lot more detail. It includes specific information on active and closed credit accounts and how you managed your payments. It also includes derogatory events like collection activity and public filings like bankruptcies or lawsuit judgments.

Many businesses use credit scoring to establish your eligibility for financing or to determine the interest rate they offer you. And they analyze your credit report to determine if you manage credit well, to verify the amount of debt you carry, and to make sure that you can afford any loans they approve for you.

Credit score and credit report are related in that credit scores are based on much of the detail contained in your credit report.

Credit Score Chart: How Is Credit Score Determined?

Credit score models differ, but most commonly use a scale of from 300 to 850 to rate credit from bad to excellent.

Your credit score is based on a combination of different parts of your credit report. The factors that play a bigger part in determining if you are likely to go bankrupt get more weight than lesser considerations – for instance, how you have paid creditors in the past is much more important than the types of accounts (credit mix) that you have.

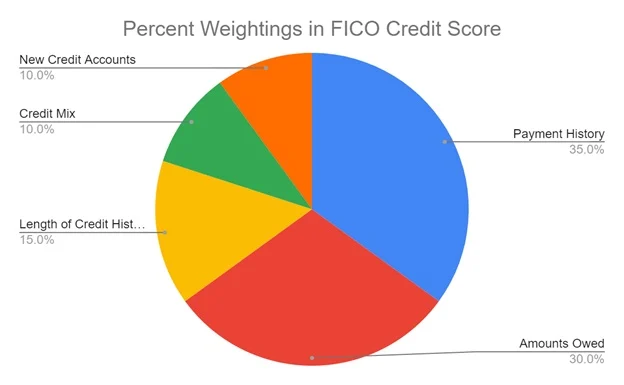

Using the FICO score as an example, the following pie chart shows how different factors make up your credit score.

Other credit models may use different weightings but are generally based on similar data about your credit usage.

Why Is Your Credit Score Important?

Credit bureaus collect details on your credit usage, credit scoring models calculate credit scores, and merchants and other businesses use those scores to make decisions about working with you… why does everybody go to so much trouble?

How accurately a business can assess the risk of extending someone credit can make the difference between a profitable relationship and a money-losing one. This affects not just whether they will let you have credit, but also how much they will charge you for it.

So, if you plan to get a mortgage, a car loan, a credit card, or use any other form of credit, your credit score can make the difference between approval and denial.

Your credit score also affects how much of a down payment you have to make on some loans, and what interest rate you get. A 20-point or smaller difference in credit score can cost you thousands of dollars in interest charges on a long-term loan like a mortgage.

Other types of businesses may look at your credit score or credit history as an indication of how responsible you are. Examples include:

Employers trying to assess how reliable a prospective employee is

Landlords who want to know how likely you are to keep up with your rent payments

Car rental companies that want to know whether you should be trusted with an expensive vehicle

Insurance companies that use a credit score to indicate how likely you are to file a claim

What Is a Good Credit Score?

Since a credit score can affect so many aspects of your life, it’s in your best interest to maintain a good credit score. But just what is a good credit score?

Broadly speaking, lenders break borrowers down into two categories: prime and subprime.

Prime means people who have reasonably good credit scores. They are more likely to get approved for credit and get average or better loan terms.

People with credit scores between 670 and 850 are generally considered prime borrowers. Lenders often further break prime borrowers down into categories of good, very good, and exceptional.

So, a good credit score is anything 670 or higher -- and the higher the better.

What Is a Bad Credit Score?

A credit score below 670 is considered subprime, or a relatively bad credit score.

Being a subprime borrower doesn’t mean you can’t get credit. It does mean your chances of getting approved are lower, especially in a weak economy. It also means that when you do get credit, you’ll probably pay more for it than prime borrowers.

Subprime borrowers are often further broken down into categories of poor and fair. People with poor credit (generally, a credit score below 580) are likely to have a hard time getting credit and if they do it will be very expensive.

Credit Score Chart: From Best to Worst

Each lender has its own standards, and there are different credit scoring models. In general, though, the chart below summarizes roughly what different ranges of credit score mean in terms of how you are viewed as a borrower:

| Credit Score | Quality | Best Loan Options | Borrowing Conditions |

|---|---|---|---|

| 800 to 850 | Exceptional | All forms of credit should be available | High approval rates Lowest available interest rates Lowest down payments Best credit card rewards |

| 740 to 799 | Very Good | All forms of credit should be available | High approval rates Low interest rates, Low down payments, Wide range of credit card rewards options, May not qualify for the most elite credit cards |

| 670 to 739 | Good | Most forms of credit should be available | Approval may depend on factors such as loan-to-value and debt-to-income ratios, Interest rates will be average to good, May not qualify for the best credit card offers |

| 580 to 669 | Fair | Student loans, Personal loans, Auto loans, FHA mortgages, Secured credit cards, Retailer-issued credit cards | Considered a subprime borrower, May not qualify for a conventional mortgage, Credit card options will be limited, Credit availability will get much tighter in a slow economy, Credit terms (rates, fees and rewards) will generally be worse than average |

| 300 to 579 | Poor | Student loans, Personal loans, Auto loans, Secured credit cards, Retailer-issued credit, | Considered a subprime borrower, Unsecured credit cards will be very difficult to get, Those with credit cards are likely to pay the highest interest rates, Expect low credit limits and loan amounts, FHA mortgages may be possible for those at the high end of this range but likely to require larger down payments, Many forms of credit will be unavailable especially when the economy is slow, Those forms of credit that are available are likely to carry the highest rates and fees |

Taking Control of Your Credit Score

Since your credit score can affect so many aspects of your life, you should make an effort to manage your credit score. Here are some ways to do that:

Check your credit report regularly. Federal law entitles you to one free credit report per year from each of the three credit bureaus.

Correct any mistakes on your credit report. Contact the credit bureau if a report from that bureau includes incorrect information.

Use credit regularly. Recent information has the greatest impact on credit reports.

Use credit responsibly. Making all your payments on time and in full is the best way to build a good credit history.

Pick your spots for opening new accounts. Suddenly adding a lot of new credit accounts is considered potentially risky behavior.

Your credit score and your credit report tell a story of how you manage your finances. Since people you want to do business with are going to be looking at that story, shouldn’t you control what’s in it?

Debt relief stats and trends

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during November 2024. The data uncovers various trends and statistics about people seeking debt help.

FICO scores and enrolled debt

Curious about the credit scores of those in debt relief? In November 2024, the average FICO score for people enrolling in a debt settlement program was 586, with an average enrolled debt of $25,411. For different age groups, the FICO scores varied. For instance, those aged 51-65 had an average FICO score of 587 and an enrolled debt of $26,912. The 18-25 age group had an average FICO score of 550 and an enrolled debt of $14,146. No matter your age or debt level, it's reassuring to know you're not alone. Taking the step to seek help can lead you towards a brighter financial future.

Credit card debt - average debt by selected states.

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) the average credit card debt for those with a balance was $6,021. The percentage of families with credit card debt was 45%. (Note: It used 2022 data).

Unsurprisingly, the level of credit card debt among those seeking debt relief was much higher. According to November 2024 data, 88% of the debt relief seekers had a credit card balance. The average credit card balance was $15,618.

Here's a quick look at the top five states based on average credit card balance.

| State | Average credit card balance | Average # of open credit card tradelines | Average credit limit | Average Credit Utilization |

|---|---|---|---|---|

| District of Columbia | $16,967 | 7 | $24,102 | 121% |

| Arkansas | $12,989 | 9 | $28,791 | 83% |

| Tennessee | $13,822 | 9 | $27,261 | 82% |

| New Mexico | $11,860 | 8 | $25,731 | 82% |

| Kentucky | $12,834 | 8 | $26,156 | 81% |

The statistics are based on all debt relief seekers with a credit card balance over $0.

Are you starting to navigate your finances? Or planning for your retirement? These insights can help you make informed choices. They can help you work toward financial stability and security.

Regain Financial Freedom

Seeking debt relief can be the first step toward financial freedom. Are you struggling with debt? Explore options for debt relief to regain control of your finances. It doesn't matter how old you are or what your FICO score or credit utilization is. Take the first step towards a brighter financial future today.

Show source

I just got a raise. Will that help my credit score?

No. This may help you get credit, but your credit score is based strictly on how you’ve used credit, not on your overall financial means.

Will a secured credit card count toward my credit score?

Yes, as long as the card issuer reports your payment record to one or more of the big three credit bureaus. Also, even though you provide a deposit to secure the card, you’ll still have to make monthly payments. How reliably you make these payments will determine whether having the card helps your credit score.

What can I do if I think my credit score is wrong?

Get credit reports from each of the three credit bureaus. Check for inaccuracies. Not only might they be erroneously reporting a past credit problem, but they might reveal accounts you were unaware of that have been opened in your name. That can be a warning sign for fraud. First, contact any credit source that is showing inaccurate payment history or account information. Then, when you’ve cleared things up with them, contact each credit bureau that was reporting the inaccurate information. Keep written records of all these communications.