Teach Your Kids How to Use a Credit Card Before College

UpdatedApr 15, 2025

- Teach your kids about credit cards before they go away to college.

- First-time credit card users can get into trouble quickly by overspending.

- Teach your kids that credit cards are not free money and that they are for convenience, not to pay for things you can't afford.

Table of Contents

Parenting comes with many responsibilities, including teaching your kids financial literacy. And in an age where so many of our purchase transactions are digitized, it’s more important than ever to teach your kids how to use a credit card.

According to a survey by T. Rowe Price, 17% of parents said that their child has a credit card. If your child has a credit card or you’re thinking of giving them one, it could offer the opportunity for them to learn good credit card habits early on – – you just need to make sure to give them the right guidance instead of letting them figure out how to use a credit card on their own.

Whether your kids are heading off to school this year or will still be at home for a while, here are four lessons you can teach your children about how to use a credit card before they go off to college.

Lesson #1 – Credit cards are not free money

Inexperienced credit card users can quickly rack up debt because they often spend money they don’t have. Responsible credit card use starts with understanding that using a credit card isn’t spending free money — it’s the opposite. Using a credit card is borrowing money that will need to be paid back, and with interest, if you don’t pay in full.

You can teach your kids to view a credit card as a middleman for making purchases. The card makes the purchase and in turn, the holder (your child) pays the credit card. To make sure your child doesn’t spend money they don’t have, have them look at their bank balance before they make a purchase. The amount they can spend is their checking account balance minus their credit card balance.

It’s important they look at the full card balance and not just the single purchase they want to make. Otherwise, they can quickly out-spend their account balance and not be able to pay off the card each month.

Lesson #2 – Responsible credit card usage can help build credit

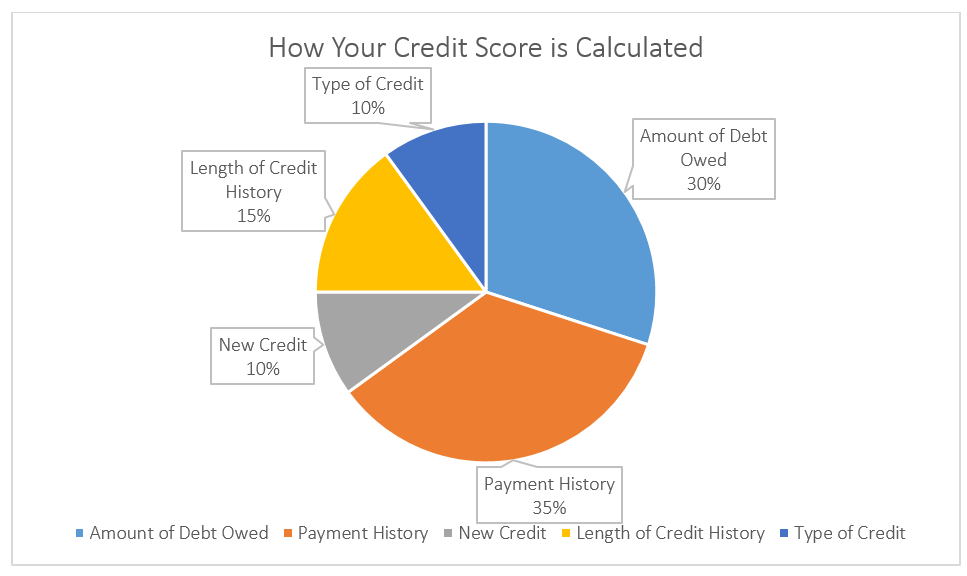

According to myFICO, 15% of your credit score is determined by the length of credit history, which means the earlier your kids establish credit, the higher the chance their score could increase. In addition, payment history makes up 35% of how a credit score is calculated, so a long history of on-time payments could dramatically help your child’s credit score.

Establishing credit early on could help your child start adulthood with good financial health. A strong credit score can help gain access to credit cards that offer benefits like cashback or rewards programs. It can also help lower car insurance premiums, get approval for leasing or renting an apartment, and access to more favorable mortgage terms later in life.

Avoid letting your kids equate the need to build credit with the need to accumulate debt. While credit scores are an important part of financial health, becoming too fixated on a credit score can do more harm than good. Educate your kids on the difference between building a credit score to further their goals, and using their score to simply gain access to more credit and thus, more debt. Show them there are many smart ways to use credit cards, even during a recession, that can help build their credit score.

Lesson #3 – Never pay interest

One of the easier rules to teach your kids about how to use a credit card is to never pay interest. It may seem obvious, but the best way to avoid paying interest is to pay your statement balance in full every single month. One way to help them understand the concept of credit card interest is to discuss an item they want to purchase like this:

Your child wants to buy a new pair of sneakers for their senior year. The cost of the sneakers is $100. If they buy the shoes with their credit card and don’t pay off the credit card on time, 30% may be charged in interest. That leaves these two options:

Option 1 – Buy the $100 sneakers and pay the full $100 credit card balance at the end of the month.

Option 2 – Buy the $100 sneakers and delay paying off the credit card balance and pay an extra $30 for the same pair of sneakers.

Would they rather pay $100 or $130 for the same pair of shoes? It’s an easy choice when you present the real cost of each purchase on a credit card.

Lesson #4 – Only paying minimums costs more in the long run

An important lesson that even adults sometimes have to learn is what happens when you only pay the minimum balance each month. Paying just the minimum balance means that you’ll have some of the balance remaining, and you will be charged interest. Not only will you be charged interest, it will take you longer to pay off your total card balance.

Here is one way to illustrate what can happen if you pay only the minimum required payment for a month. Pull out your own credit card statement and show your child the difference between paying the minimum payment versus paying the balance off in full. Most credit card statements provide examples using your account balance and minimum payment. By showing your teen how minimum payments work, you give both transparency about your finances, and a real world example of how to use credit cards wisely.

Bonus: 3 credit card features that work well for college students

If you’re interested in helping your college student get off on the right financial foot, a credit card that keeps their finances simple is a great way to do it. Look for these three features while you shop for a credit card for your student:

No annual fee – look for a card that has no annual fee, which makes it easy to manage on a shoestring budget.

Cashback offers – every day purchases, like gas, groceries, or restaurants can go further with a cashback card.

Built-in incentives – some cards offer discounts and rewards for good grades or paying on time and in full.

Financial knowledge starts with you

Passing along healthy financial habits to your children is a great way to change your family’s financial future for the better. Financial knowledge starts with brushing up on ways to manage not just your money but existing debt, as well. The Freedom Debt Relief debt management guide can walk you through several options and help you formulate a plan. Start by downloading the How to Manage Debt guide here.

Learn more:

Remote Learning at College: Will Your Student Loans Change? (Freedom Debt Relief)

Money Tips for Recent College Grads: Recession Edition (Freedom Debt Relief)

Credit Cards for Kids: How to Jump-Start Your Kid’s Credit Score (WealthFit)

Insights into debt relief demographics

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during November 2024. The data provides insights about key characteristics of debt relief seekers.

FICO scores and enrolled debt

Curious about the credit scores of those in debt relief? In November 2024, the average FICO score for people enrolling in a debt settlement program was 586, with an average enrolled debt of $25,411. For different age groups, the FICO scores varied. For instance, those aged 51-65 had an average FICO score of 587 and an enrolled debt of $26,912. The 18-25 age group had an average FICO score of 550 and an enrolled debt of $14,146. No matter your age or debt level, it's reassuring to know you're not alone. Taking the step to seek help can lead you towards a brighter financial future.

Personal loan balances – average debt by selected states

Personal loans are one type of installment loans. Generally you borrow at a fixed rate with a fixed monthly payment.

In November 2024, 44% of the debt relief seekers had a personal loan. The average personal loan was $10,718, and the average monthly payment was $362.

Here's a quick look at the top five states by average personal loan balance.

| State | % with personal loan | Avg personal loan balance | Average personal loan original amount | Avg personal loan monthly payment |

|---|---|---|---|---|

| Massachusetts | 42% | $14,653 | $21,431 | $474 |

| Connecticut | 44% | $13,546 | $21,163 | $475 |

| New York | 37% | $13,499 | $20,464 | $447 |

| New Hampshire | 49% | $13,206 | $18,625 | $410 |

| Minnesota | 44% | $12,944 | $18,836 | $470 |

Personal loans are an important financial tool. You can use them for debt consolidation. You can also use them to make large purchases, do home improvements, or for other purposes.

Support for a Brighter Future

No matter your age, FICO score, or debt level, seeking debt relief can provide the support you need. Take control of your financial future by taking the first step today.

Show source