What You Should Know About Access to Student Loans

UpdatedApr 14, 2025

- Affordable student loans provide access to higher education for people with less wealth.

- However, access to student loans is not always equal.

- Borrowers should research colleges and loans carefully to make sure they can afford the terms and that they get good value for their money.

Table of Contents

As our contribution to the ongoing discussion America is having around racial inequality, here is another post in our Financial Discrimination, Access, and Equity series. We will continue to share information about how to recognize and help combat financial discrimination, so please come back to read future posts.

We’re often told that higher education is the rising tide that lifts all boats, giving graduates access to an ocean of opportunities regardless of background or skin color. The value of a college degree is quantifiable, with the median weekly earnings for college graduates with a bachelor’s degree at $1,173 in 2017, compared to just $712 for those with a high school diploma, according to the U.S. Bureau of Labor Statistics.

Yet, access to a college education and financial outcomes after attending school don’t neatly fit into the rising tide metaphor. This is often especially true for African Americans and other minorities—and women of color in particular—who have been on the wrong side of the racial wealth gap for generations.

The effects of the wealth gap can be demonstrated by the amount of debt minority students must take on, compared to their white friends. People of color are more likely to take out student loans (and borrow more) than non-minority students, in part because their families may be less likely to have their own resources. Studies show minorities also are often targeted by predatory for-profit institutions, tend to be more heavily concentrated in schools with fewer resources to help students succeed, and often have a more difficult time repaying their loans after leaving school, regardless of whether they graduate.

There is one additional statistic that has a major effect on the debt burden on minority students – graduation rates. The reasons for the difference in graduation rates are many, and complicated. However, the bottom line result where student loan debt is concerned is clear. Even if you don’t graduate, you still must pay back your loans, and now you’ll have less income to do that.

While none of these challenges are easily solved, students of color may have a better chance of achieving their educational and financial goals by educating themselves on some best practices for financing a college education. And for non-minority students and their parents, knowing how the system currently works gives them a chance to help create more equal opportunities for future generations.

The need for student loans: the racial wealth gap

The Higher Education Act of 1965 paved the way for equal access to student loans. The law, which was reauthorized, amended, and eventually replaced over the years, prohibits discrimination on the basis of race, national origin, religion, sex, marital status, age, or disability for federal loans.

But, even though federal student loan discrimination was not a matter of official policy like the “redlining” of mortgage loans was before the Fair Housing Act of 1968, student loan debt tracks with the same results of racial inequity. In other words, even equal access to student loans may fail to correct for generations of wealth inequality and the legacy of racial discrimination.

For example, since African American families often don’t have the family resources to send their children to college, they’re left with little choice but to take out student loans. While loans can give access to higher education, taking on this debt can set families back without a guarantee of a payoff upon graduation. This has a direct connection to the home ownership rates of African American and other minority families, which lag behind that of white families and is in turn, directly related to passing generational wealth.

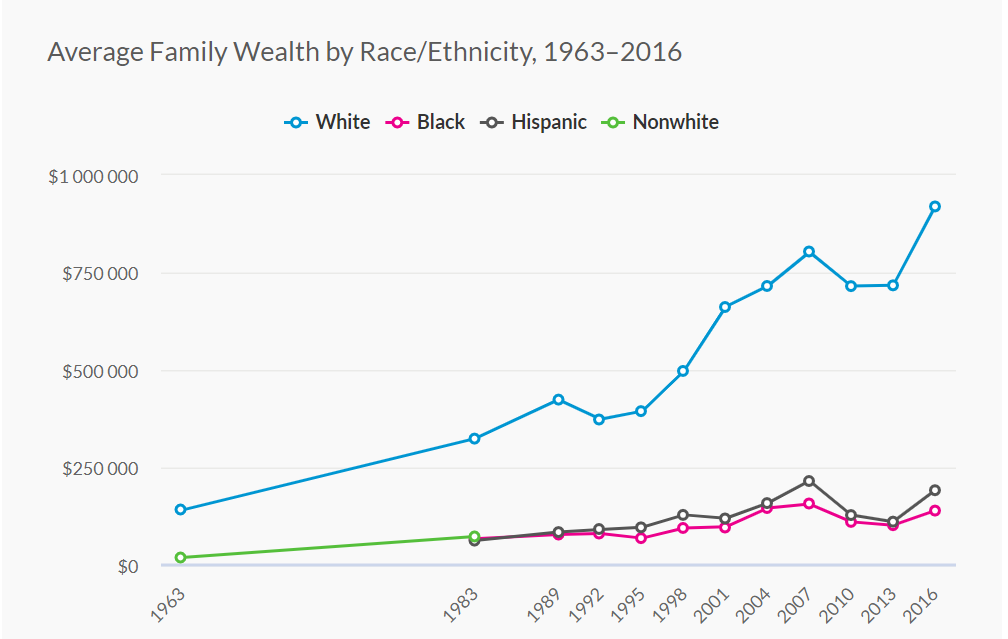

Source: Urban Institute

Notes: Median wealth by race and ethnicity is lower than average wealth, but the trends stay the same. Both measures are important because average wealth indicates how a group is prospering as a whole relative to other groups, while median wealth shows how the “typical” family is doing. 2016 dollars. No comparable data are available between 1963 and 1983. Black/Hispanic distinction within nonwhite population available only in 1983 and later.

Since the cost of a college education increased eight times as fast as wages between 1989 and 2016, according to Federal Reserve figures, it’s getting harder for students in the working and middle classes to afford higher education. Even though a college degree is more important than ever, the costs have skyrocketed and working families’ ability to pay for college has not kept pace.

Why is there racial disparity in student loan debt?

Equal access to student loans doesn’t guarantee equal opportunity, especially when you consider the burden caused by student loan debt on racial minorities. This reality can affect which schools students consider, and even what they choose to study.

Concentration in underfunded schools

Minority students are often concentrated in schools that have fewer resources to help them graduate. This includes Hispanic-Serving Institutions (HSIs) and Historically Black Colleges and Universities (HBCUs), institutions which receive far less of the massive donations that elite, white-majority colleges rely on for benefits like new programs, facilities, and scholarships.

It’s encouraging that some wealthy executives (including Netflix CEO Reed Hastings) have stepped up with donations to Historically Black Colleges and Universities (HBCUs), but it’s still a single action, not a change in the system. Elite universities such as Harvard and Stanford, in contrast, have been taking in donations to build their endowments for generations.

The high cost of for-profit schools

College-bound minorities are heavily targeted by for-profit colleges that critics say use predatory tactics to lure students with promises of abundant career opportunities after graduation. A 2014 list of vendors paid by for-profit Corinthian College exposed their heavy advertising on the Black Entertainment Television network, bus lines that run through Black neighborhoods, and other platforms that reach predominantly minority audiences.

Studies show that most of these for-profit universities leave graduates with massive debt and little to show for their education investment. For example, a 2018 Brookings Institution report found that borrowers who attend for-profit colleges default on their loans at twice the rate of borrowers who attend public universities. And since they borrow at a much higher rate than public college students, they default at four times the rate overall.

The study also shows that African American graduates with BA degrees are five times as likely to default on their student loans as are white graduates with BAs. However, it’s not so much about the amount of student loan debt as it is institutional factors, including relative financial standing and job prospects after graduation, which have been shown to be much lower for graduates of for-profit institutions, especially for minority applicants.

The gender gap and African American women

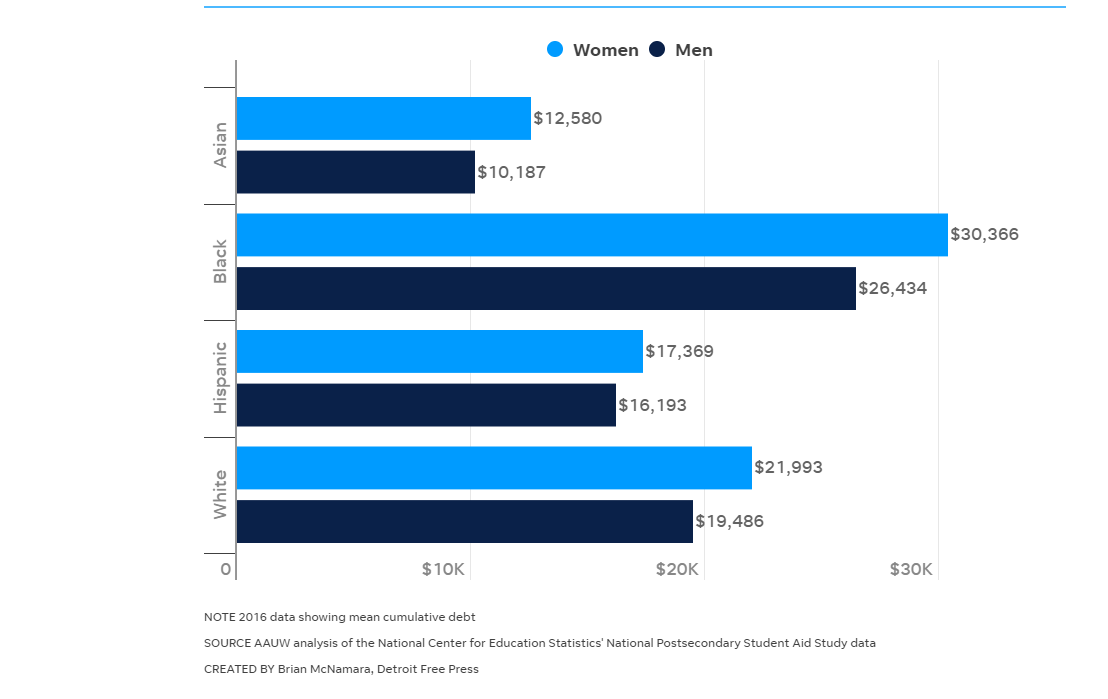

African American women stand at the crossroads of the gender and racial wealth gaps, carrying the highest average amount of student loan debt among all demographics. A 2016 study by the American Association of University Women (AAUW) cited by Black Enterprise found that women account for two-thirds of the nation’s estimated $1.4 trillion of student debt. Black women graduate with an average debt load of $30,400, compared to $22,000 for white women.

Source: Detroit Free Press

While women as a whole make up just over half of all college enrollees, they account for two-thirds of outstanding student loan debt. Their ability to repay loans is made more difficult due to the fact that Black women earn just $0.63 for every dollar earned by their white male counterparts, and $0.79 compared to every dollar earned by white women.

Loan discrimination: “educational redlining”

Once minorities graduate and start their careers, they may be further discriminated against through what a 2020 study from the Student Borrower Protection Center refers to as “educational redlining.”

This study, featuring two case studies, found that alternative “education data” used when lending or refinancing student loans may unfairly penalize borrowers who take out private loans to pay for community college. If borrowers who wish to refinance their loans attended an HSI, or HBCU, they were also charged more over the life of the loan, extending the trend of economic inequality further through the student’s lifetime.

Rise above the undertow when seeking student loans

Institutionalized racism and generations of wealth inequality, the wage gap and other factors, have led to the problems with student loan debt impacting minority students. That won’t be solved without institutional change, but here are four steps you can take to help minimize your debt risk when financing your education.

1. Choose student loans carefully

Student loans fall into two main categories: government loans (state and federal) and private loans. The Consumer Financial Protection Bureau (CFPB) suggests exploring your federal student loan options first. The advantages of federal (and some state) loans include:

Fixed interest rates

Most borrowers are eligible

Repayment terms are flexible

Private student loans typically cost more than government loans, often have variable rates that may change without much notice, have less-flexible repayment options, and typically require a co-signer. However, one advantage of private loans is that you can borrow much larger amounts than you can with federal loans. This advantage, of course, presents the risk of taking on too much debt.

2. Explore your options before choosing a for-profit college

Plenty of ink has already been spilled warning students about the pitfalls of for-profit schools. If you’re adding to your skills for a specific role, or live in a very remote area, then for-profit education may be a good move. But if you plan on transferring to a university after a year or two of for-profit schooling, keep in mind that the vast majority of credits from these schools are not transferable to universities.

This is why community colleges are a great way to transition from high school to a larger institution. Not only are most credits transferable, community colleges are much more affordable and unlike mainly online colleges, offer the intangibles of at least some in person learning, like networking with peers, meeting mentors, and having a generally richer learning experience.

3. Research other financing options

If you’re able to stay at your parents’ house rent free and work for a year or two, consider delaying college until you have some money saved up. You can consider active duty military service which allows access to the GI Bill, or joining the National Guard to earn money for school. Other options include:

Do your research. Ensure you identify the various scholarships (some privately offered) for which you may be eligible, including those set aside for minority students.

Grants. Unlike loans, grants (available from the federal government and other sources) don’t have to be repaid.

Work-study arrangements. Most schools offer on-campus jobs that don’t require off-campus travel or compromise your studies.

Tax credit. You or your parents may be eligible for a $2,500 federal tax credit after paying tuition.

Negotiate with the college. It is possible to haggle with the financial aid department. Start by writing an appeal letter.

4. Understand loan forgiveness opportunities

If you’ve already finished school and have a heavy student loan debt, you may want to explore your options for loan forgiveness. Most student loans can’t be discharged through bankruptcy, but there are some limited instances—such as a financial hardship—that could qualify you for forgiveness.

Certain types of jobs, particularly those with the federal government or involving public service, may qualify you for loan forgiveness. These include physicians, nurses, teachers, workers in the non-profit sector, and government agency employees. Additionally, some private employers offer loan repayment assistance as a part of their recruiting efforts. Employers that offer this assistance include Aetna, Fidelity Investments, PricewaterhouseCoopers, and Hulu.

Don’t let discrimination take the wind out of your sails

Although the wealth gap and ongoing problems with loan discrimination make it that much more difficult for minorities to achieve their goals, Freedom Debt Relief is dedicated to doing our part to help. We’ll continue to provide information to help you navigate these challenges and understand your rights so you can better protect yourself and your financial future. Remember to come back to our blogs for additional updates and information with this series and other posts.

Learn More

The Continued Student Loan Crisis for Black Borrowers (Center for American Progress)

All the ways student loan debt exacerbates racial inequality—‘it’s like landing in quick sand’ (MarketWatch)

What You Should Know About Credit Discrimination (Freedom Debt Relief)

What protections do I have against credit discrimination? (CFPB)

Debt relief stats and trends

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during November 2024. The data uncovers various trends and statistics about people seeking debt help.

Credit card balances by age group for those seeking debt relief

How do credit card balances vary across different age groups? In November 2024, people seeking debt relief showed the following trends in their open credit card tradelines and average credit card balances:

Ages 18-25: Average balance of $9,117 with a monthly payment of $282

Ages 26-35: Average balance of $12,438 with a monthly payment of $390

Ages 36-50: Average balance of $15,436 with a monthly payment of $431

Ages 51-65: Average balance of $16,159 with a monthly payment of $529

Ages 65+: Average balance of $16,546 with a monthly payment of $499

These figures show that credit card debt can affect anyone, regardless of age. Managing credit card debt can be challenging, whether you're just starting out or nearing retirement.

Personal loan balances – average debt by selected states

Personal loans are one type of installment loans. Generally you borrow at a fixed rate with a fixed monthly payment.

In November 2024, 44% of the debt relief seekers had a personal loan. The average personal loan was $10,718, and the average monthly payment was $362.

Here's a quick look at the top five states by average personal loan balance.

| State | % with personal loan | Avg personal loan balance | Average personal loan original amount | Avg personal loan monthly payment |

|---|---|---|---|---|

| Massachusetts | 42% | $14,653 | $21,431 | $474 |

| Connecticut | 44% | $13,546 | $21,163 | $475 |

| New York | 37% | $13,499 | $20,464 | $447 |

| New Hampshire | 49% | $13,206 | $18,625 | $410 |

| Minnesota | 44% | $12,944 | $18,836 | $470 |

Personal loans are an important financial tool. You can use them for debt consolidation. You can also use them to make large purchases, do home improvements, or for other purposes.

Manage Your Finances Better

Understanding your debt situation is crucial. It could be high credit use, many tradelines, or a low FICO score. The right debt relief can help you manage your money. Begin your journey to financial stability by taking the first step.

Show source