Changes in Eviction Protection: Update

UpdatedApr 15, 2025

- Renters were extended protection from eviction because of COVID.

- Not all renters are covered -- you must have an application for COVID rental assistance.

- CDC COVID eviction protection expires June 30, 2022.

Table of Contents

On September 1, the Centers for Disease Control and Prevention (CDC) issued an order protecting qualifying renters in the U.S. from eviction beginning September 4, through December 31, 2020. This order extends the eviction protection from the CARES Act, which expired on July 24 and only protected those living in government-funded housing. The CDC order does not protect homeowners from foreclosure due to mortgage non-payment.

Why is the eviction protection order coming from the CDC?

In his executive order, President Trump gave the CDC authority to make a decision about halting evictions in the interest of public health. The eviction moratorium is based on concerns that people evicted from their homes would turn to congregate housing, such as homeless shelters, or move in with family members. More people living in close quarters can increase the spread of COVID-19.

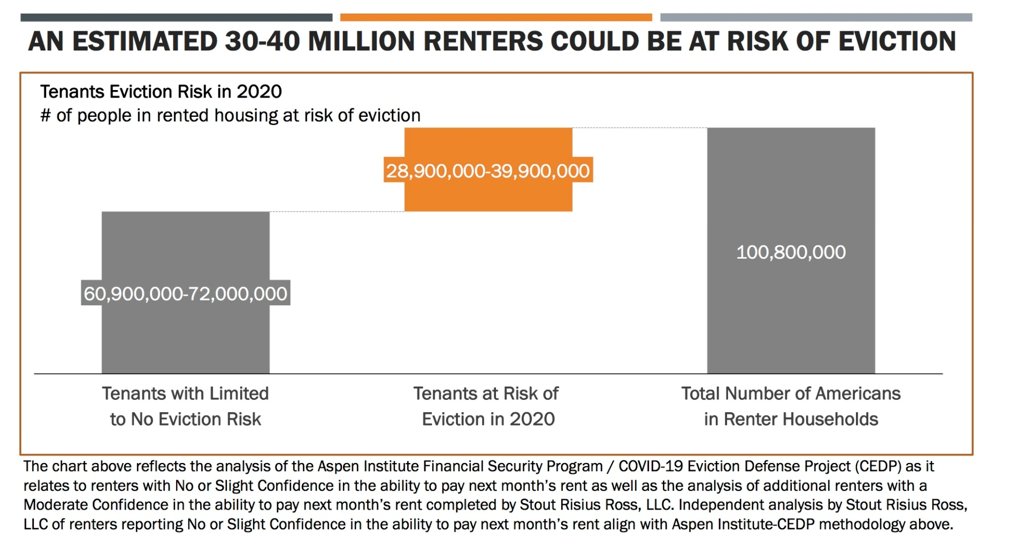

In short, it’s easier to social distance if everyone is in their own home. And given that around 40 million people are at risk of being evicted otherwise, the impact on public health—and on Americans’ lives—could be serious.

Chart courtesy of the Aspen Institute

Who is covered by the CDC eviction protection?

To qualify under the CDC guidelines, a renter must:

Be unable to pay the full rent due to loss of income, loss of wages, layoff, or extraordinary out-of-pocket medical expenses

Have made every effort to get any available government financial assistance

Expect to earn no more than $99,000 in annual income in 2020, or wasn’t required to file a 2019 tax return, or received a stimulus check as part of the CARES Act

Whenever possible, make rent payments as close to the full amount as possible

Have no other housing options and therefore be in danger of becoming homeless or having to move into close quarters with others

Even if renters qualify under these criteria, it’s important to note that they can still be evicted for breaking any other parts of their lease agreement, such as property damage or disorderly conduct.

Will renters still owe rent if they qualify for eviction protection?

Yes. The amount a tenant usually owes will still be due to the landlord eventually, either once all rental moratoria in the area expires or when the tenant no longer meets the qualification criteria. At that point, depending on the terms of the lease agreement and the willingness of the landlord to work with their tenant, the landlord may:

Sue to evict unless all back rent is paid immediately

Allow a back-rent payment plan, probably in addition to the cost of normal rent

The CDC order also says that landlords have the right to charge any fees, penalties, or interest according to the terms of the lease agreement. So while the CDC eviction protection order provides much-needed temporary relief from eviction for many households, it’s just that — temporary.

What should renters do if they receive an eviction notice?

If a tenant receives an eviction notice even though they believe they qualify for eviction protection, they should:

Make sure they meet the criteria to qualify

Complete the form provided by the CDC for each person on the lease agreement

Give the completed form(s) to their landlord

Who does not have eviction protection?

It’s important to understand the CDC eviction protection order won’t prevent eviction if the renter:

Meets some, but not all, of the qualification criteria

Violates other parts of the lease agreement that could lead to eviction

Lives in temporary housing (like an extended stay hotel or seasonal housing)

Is a resident of American Samoa (where there are no COVID cases)

Is a homeowner paying a mortgage, not rent

If you’re a homeowner who can’t pay your mortgage due to the coronavirus crisis, or you own a rental property and can’t make your mortgage payments because your tenants aren’t paying rent, a good course of action is to contact your mortgage lender and ask them if they can defer your payments or accept partial payments.

What about state and local eviction protections?

State or local rental moratoria will prevail if they give more rights to renters than the CDC eviction protection order. For example, California’s new state law states that any back rent owed by tenants after the moratorium ends can’t be grounds for eviction at that time, which is an extra bit of protection not included in the CDC order. The California law also extends the moratorium to January 31, 2021, a full month later than the CDC order.

Do an internet search for eviction protection in your state, county, and city. You can also look for helpful online summaries of government protections for renters.

What to do next:

If you qualify for eviction protection, make sure you:

Seek all possible forms of financial assistance from federal, state, and local sources

Fill out the CDC declaration form and give it to your landlord

Prioritize paying rent over less important bills like discretionary expenses and unsecured debt payments

Pay as much as you can toward rent each month to reduce the amount of back rent you’ll owe

Relief from credit card payments

If you’re unable to pay both rent and credit card payments due to a financial hardship, you may want to consider debt relief. Through a debt relief program, you creditors may be willing to settle for less than you owe on some or all of your unsecured debts. To learn more, talk to a Freedom Debt Relief Certified Debt Consultant. They can either help you find out if you qualify for our debt relief program, or help you find another debt solution that could help. Get started now.

Learn More:

Does Eviction Protection Still Apply to You? (Freedom Debt Relief)

If You Missed Your Stimulus Check for Dependents, You have Another Chance (Freedom Debt Relief)

3 Things You Might Need More Than a Stimulus Check (Freedom Debt Relief)

Reducing Expenses During a Sudden Financial Hardship (Freedom Debt Relief)

Insights into debt relief demographics

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during November 2024. The data provides insights about key characteristics of debt relief seekers.

FICO scores and enrolled debt

Curious about the credit scores of those in debt relief? In November 2024, the average FICO score for people enrolling in a debt settlement program was 586, with an average enrolled debt of $25,411. For different age groups, the FICO scores varied. For instance, those aged 51-65 had an average FICO score of 587 and an enrolled debt of $26,912. The 18-25 age group had an average FICO score of 550 and an enrolled debt of $14,146. No matter your age or debt level, it's reassuring to know you're not alone. Taking the step to seek help can lead you towards a brighter financial future.

Personal loan balances – average debt by selected states

Personal loans are one type of installment loans. Generally you borrow at a fixed rate with a fixed monthly payment.

In November 2024, 44% of the debt relief seekers had a personal loan. The average personal loan was $10,718, and the average monthly payment was $362.

Here's a quick look at the top five states by average personal loan balance.

| State | % with personal loan | Avg personal loan balance | Average personal loan original amount | Avg personal loan monthly payment |

|---|---|---|---|---|

| Massachusetts | 42% | $14,653 | $21,431 | $474 |

| Connecticut | 44% | $13,546 | $21,163 | $475 |

| New York | 37% | $13,499 | $20,464 | $447 |

| New Hampshire | 49% | $13,206 | $18,625 | $410 |

| Minnesota | 44% | $12,944 | $18,836 | $470 |

Personal loans are an important financial tool. You can use them for debt consolidation. You can also use them to make large purchases, do home improvements, or for other purposes.

Manage Your Finances Better

Understanding your debt situation is crucial. It could be high credit use, many tradelines, or a low FICO score. The right debt relief can help you manage your money. Begin your journey to financial stability by taking the first step.

Show source