Food Prices Spike: How to Update Your Grocery Budget

UpdatedApr 13, 2025

- You have to eat. When food prices rise, you must adjust your budget -- or your eating habits.

- Healthier diet choices can also save you money.

- Eating out a little less often can help you stay on budget when food costs rise.

Table of Contents

Have you noticed that grocery prices have gone up? The US Bureau of Labor Statistics reported that the index for food at home went up by 2.6% in April, the largest spike since February 1974. Prices increased the most for meat, poultry, fish, and eggs.

For the average US household, food makes up 9.7% of the total household budget (5% food at home, 4.7% eating out). While that’s a lower percentage than in developing nations, it’s still a significant expense, and one that can only be trimmed so far, since it’s an essential need.

When finances are tight, many households resort to putting groceries and other essentials on their credit cards. But it can be risky to continue to add more debt onto your credit cards right now, especially if your income has been reduced. Here are some ways you can adjust your food budget to avoid relying too much on your credit card and taking on more debt.

Move money from other parts of your budget

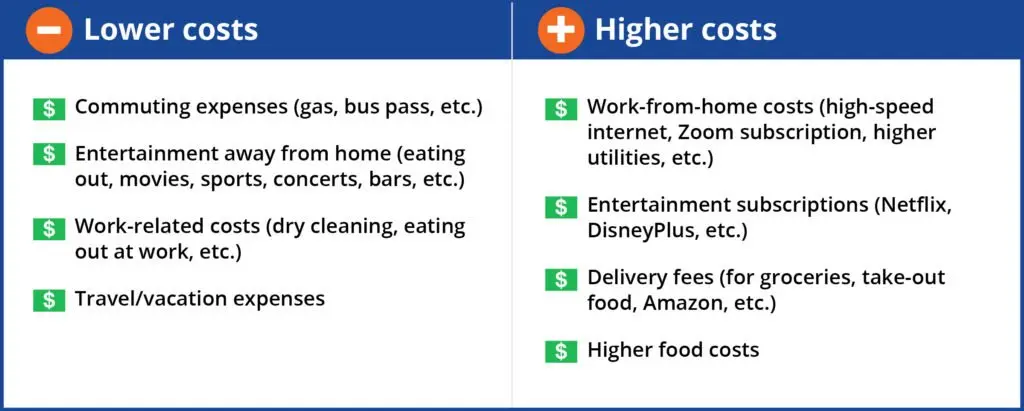

Even though food prices are up, some other costs are probably down for you right now. Start moving money from those areas of your budget into your food budget. For example, you may find you’re spending less money on gas, dry cleaning, eating out, entertainment, and travel right now.

To get an idea of where you can find extra money in your budget for food, compare two bank or credit card statements: One from before the pandemic struck (your “normal” spending) and one from the past month (your “new” spending). Then, on a piece of paper, create two columns for expenses that have gone up and expenses that have gone down. Here are some examples:

Add more fruits and veggies to your diet

One way to adjust your food budget is to shop differently. Prices for fresh fruits and vegetables have not gone up, most likely because they can’t be hoarded due to their short shelf life. This means you can walk into your local grocery store (or place a delivery order) and have a good selection of nutritious items from the produce section. Many fresh foods can be frozen, canned, or pickled for later use, so if you have the extra time at home, this could be an affordable way to stock up food for future use.

Explore meat alternatives

Even during the best of times, meat is expensive relative to other foods. With recent COVID-19 outbreaks at meat packing plants, meat will likely become scarcer and therefore even more expensive. This means that now is a good time to explore less expensive ways to get your protein, and also to simply cut back on how much meat you consume.

For a price comparison, here are some common protein sources, in order from least to most expensive. The prices are from the same grocery store on the same day, in one location. Your prices may vary, but this should give you some ideas:

Tuna (1 can) – $.079

Tofu (14 oz) – $1.79

Eggs (1 dozen large) – $2.39

Milk (1 gallon) – $2.69

Quinoa (16 oz) – $4.99

Ground beef (1 lb) – $5.29

Beyond Burger plant-based “ground beef” (1 lb) – $9.99

Salmon (1 filet) – $12.05

Updated price list, September 2, 2020: In the four weeks preceding August 22, prices rose. Some key

Eggs up 16.5%

Cheese up 7.3%

Lunch meat up 8.1%

Diapers up 8.8%

Laundry detergent up 9.2%

Let’s explore a few meat alternatives to consider if you’d like to modify your food budget:

Tofu

A rich source of protein, yet easy on the wallet. Tofu is bland by itself, but there are many ways to cook and spice it so that it tastes delicious. It stores well and has a shelf life of a few months in the fridge, but these qualities mean it might be a bit harder to find in stores right now.

Eggs

Despite the cost of eggs ticking up, they’re still a less expensive source of complete protein than meat. Plus, they’re versatile and can be used in a wide variety of dishes.

Quinoa

A great substitute for rice or couscous, containing all nine essential amino acids. It has a nutty taste, similar to brown rice. It’s sometimes out of stock due to pandemic hoarding, but it may be easier to find than rice at the moment.

Milk and cheese

Rich in protein, but often also rich in fat. Still, if you’re cutting back on meat, adding in some extra dairy may be just what you need to get enough protein and that feeling of fullness.

Buy in bulk (but don’t overdo it)

If you’re looking for food savings, warehouse stores like Costco may have larger quantities at a reasonable price. But be realistic about how much you can store and if you can use the food before it expires.

Re-evaluate your everyday eating habits

If the foods you typically eat are hard to find or too expensive, you can turn the situation to your advantage by changing your eating habits so that they’re healthier. For example, if you tend to eat more calories than you really need, cutting down on portion sizes could allow you to:

Still eat the foods you enjoy, just in smaller quantities

Lose weight

Save money on food

If you or someone in your family has lost their job due to the pandemic, using that extra time to learn how to cook healthy recipes with new ingredients can not only cut down on the cost of eating out, but also lead to healthier eating, fewer calories consumed, and greater flexibility in your meal choices.

Be creative and flexible

This unprecedented time provides an opportunity for us to rethink our habits and routines, from how we eat to how we spend money and how we connect with people we care about. The keys to staying healthy — both physically and mentally — are flexibility and creativity.

Let us help

Whether you’re reworking your household budget or just trying to figure out how to manage your money next week, be ready to roll with the punches and look for ways to turn the negatives of the current situation into positives — at least as much as you can. Let us help you. You can download our free debt guide and learn ways to manage your money, your budget, and set yourself up for a brighter financial future.

Editor’s Note, Sept. 2, 2020: This post has been updated to reflect news on further increases in food prices.

Learn More:

How to Manage Debt in a Financial Emergency (Freedom Debt Relief)

How to Prepare for a Recession If You are Already Struggling (Freedom Debt Relief)

How to Ask Creditors for Loan and Credit Card Forbearance (Freedom Debt Relief)

Debt relief stats and trends

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during November 2024. The data uncovers various trends and statistics about people seeking debt help.

Credit card balances by age group for those seeking debt relief

How do credit card balances vary across different age groups? In November 2024, people seeking debt relief showed the following trends in their open credit card tradelines and average credit card balances:

Ages 18-25: Average balance of $9,117 with a monthly payment of $282

Ages 26-35: Average balance of $12,438 with a monthly payment of $390

Ages 36-50: Average balance of $15,436 with a monthly payment of $431

Ages 51-65: Average balance of $16,159 with a monthly payment of $529

Ages 65+: Average balance of $16,546 with a monthly payment of $499

These figures show that credit card debt can affect anyone, regardless of age. Managing credit card debt can be challenging, whether you're just starting out or nearing retirement.

Home-secured debt – average debt by selected states

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) (using 2022 data) the average home-secured debt for those with a balance was $212,498. The percentage of families with mortgage debt was 42%.

In November 2024, 25% of the debt relief seekers had a mortgage. The average mortgage debt was $236504, and the average monthly payment was $1882.

Here is a quick look at the top five states by average mortgage balance.

| State | % with a mortgage balance | Average mortgage balance | Average monthly payment | |

|---|---|---|---|---|

| California | 20 | $391,113 | $2,710 | |

| District of Columbia | 17 | $339,911 | $2,330 | |

| Utah | 31 | $316,936 | $2,094 | |

| Nevada | 25 | $306,258 | $2,082 | |

| Massachusetts | 28 | $297,524 | $2,290 |

The statistics are based on all debt relief seekers with a mortgage loan balance over $0.

Housing is an important part of a household's expenses. Remember to consider all your debts when looking for a way to get debt relief.

Tackle Financial Challenges

Don’t let debt overwhelm you. Learn more about debt relief options. They can help you tackle your financial challenges. This is true whether you have high credit card balances or many tradelines. Start your path to recovery with the first step.

Show source