Should Your Company Reimburse Work-From-Home Expenses?

UpdatedApr 16, 2025

- Should your company be reimbursing work from home costs?

- Some states require companies to cover employees work from home costs.

- You may be eligible for reimbursement of phone, internet and equipment costs.

Table of Contents

For many employees, the coronavirus pandemic has made working from home a requirement, rather than simply an option. If you’re working from home, you may have noticed that some expenses such as car maintenance and repairs, gas, tolls, and business attire have gone down.

Other expenses like utilities, computers, laptops, ergonomic office furniture, apps, software, and your phone or internet bill, however, have likely increased. So if your company mandates that you work from home, should they reimburse some of the expenses you incur to get your job done?

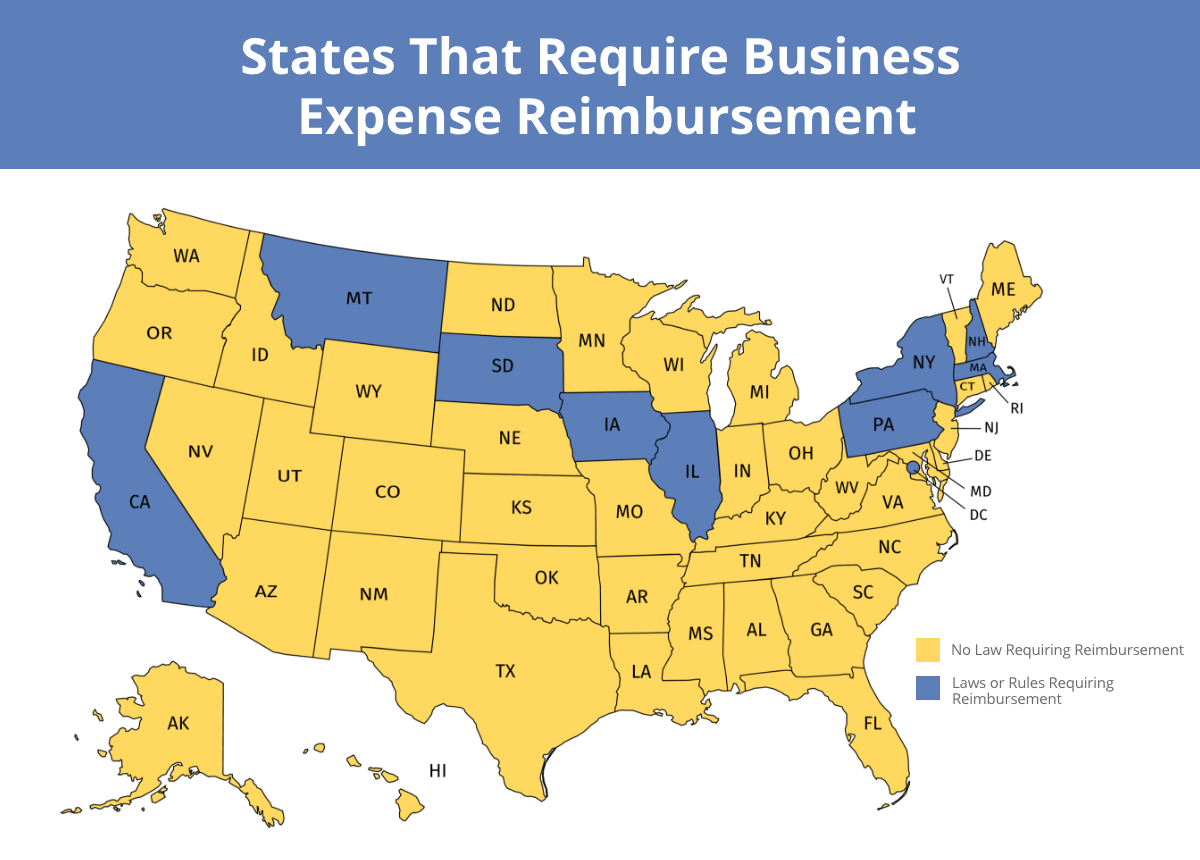

Most states do not require reimbursements

Despite the fact that working from home is more common today than ever before, most states do not have laws mandating employers reimburse employees specifically for work from home expenses. However, if you earn minimum wage or close to it, your employer may be legally obligated to reimburse you under the federal Fair Labor Standards Act. The Fair Labor Standards Act states that your employer cannot require you to cover work expenses if doing so would reduce your earnings to below the required minimum wage threshold.

Fortunately, some employers in these states are paying for some work from home expenses even though they aren’t required to. Buffer, a software application company, for example, provides each employee with $500 to arrange their home office and a $200 annual stipend for technology costs. The cloud computing company, Box, offers a $600 work from home stipend for all of its employees.

States that may require reimbursements

If you work from home in California, Illinois, Massachusetts, Iowa, Montana, or D.C., you’re in a different position. Your employer may be required to reimburse you for work from home expenses, no matter how much you earn.

Here’s a brief overview the requirements from those states which mandate reimbursement:

California: Section 28202 of the California Labor Code states that employers must reimburse their workers for “reasonable and necessary expenses” they incur while completing their job duties. This applies whether or not an employee’s expenses push them below the minimum wage.

Illinois: Illinois requires that “all necessary expenditures or losses” that an employee takes on and that are “directly related to services performed for the employer” are reimbursed.

Massachusetts: Although Massachusetts doesn’t require work from home expenses to be reimbursed, it does prevent employers from placing its costs onto employees that cause their earnings to fall below minimum wage.

Iowa: Employers must reimburse employees for expenses within 30 days after employees submit expense claims or provide written documents explaining why the reimbursement has been refused within the same time period.

Montana: According to Montana law, employers must pay for any business expenses that an employee pays as a direct consequence of their duties and responsibilities as an employee, or as a result of the directions of their employer.

Washington D.C.: In Washington D.C., employers are required to cover the cost of “purchasing and maintaining any tools required” for employees to perform their work responsibilities.

Because of the pandemic, this is an area of law that is already undergoing change, so ask your HR team what your company policy is. If you don’t think it complies with state and federal law, you can also seek advice from an attorney in your area.

Types of reimbursable expenses

It’s important to note that not all work from home expenses are reimbursable. The ones that are necessary for you to perform your job, however, may be. These can include:

Your phone and/or internet plan

Personal desktop or laptop computer

Teleconferencing software

Fax machines

Other expenses that are designed to make your working conditions easier and convenient often aren’t reimbursed. Some examples of these “nice to have” rather than “must have” expenses may include ergonomic chairs, higher speed internet, and high-quality printers.

How to save money on work from home expenses

Regardless of whether or not you’re receiving reimbursement from your employer, there are several ways to manage your work-from-home expenses, including:

Shop around for phone and internet plans: Some providers are more affordable than others. That’s why it’s well worth your time to shop around, compare prices, and find the very best deal for your phone and internet services.

Consider used furniture: If you’re in need of a better desk, an ergonomic chair, or another piece of furniture for your home office, you don’t have to buy it brand new. Look Facebook Marketplace, or a site like Cubicles.com which specializes in used office furniture.

Visit discounts stores for supplies: To save on paper, pencils, sticky notes, and other office supplies, buy from dollar or discount stores rather than your local grocery or drugstore, which may charge more for these same items.

Prepare your own lunches: It may be tempting to get out of the house and go to a drive-thru, or order food delivered when it’s time to break for lunch. Since doing so can add up very quickly, get into the habit of using your lunch break to prep your own lunches at home.

Overwhelmed with coronavirus-related expenses? We can help.

If you’re dealing with debt due to work from home expenses and other expenses, you don’t have to deal with it alone. The Freedom Debt Relief How to Manage Debt guide will walk you through your options on how to manage all types of debt, including medical debt. Start learning your options by downloading the free guide right now.

Learn More

Can You Keep Your Unemployment Benefits if You Refuse to Return to Work? (Freedom Debt Relief)

What is Budget Billing? (Freedom Debt Relief)

Budgeting 101: The Basics on How to Budget (Freedom Debt Relief)

Debt relief by the numbers

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during November 2024. This data reveals the diversity of individuals seeking help and provides insights into some of their key characteristics.

Age distribution of debt relief seekers

Debt affects people of all ages, but some age groups are more likely to seek help than others. In November 2024, the average age of people seeking debt relief was 49. The data showed that 17% were over 65, and 18% were between 26-35. Financial hardships can affect anyone, no matter their age, and you can never be too young or too old to seek help.

Student loan debt – average debt by selected states.

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) the average student debt for those with a balance was $46,980. The percentage of families with student debt was 22%. (Note: It used 2022 data).

Student loan debt among those seeking debt relief is prevalent. In November 2024, 27% of the debt relief seekers had student debt. The average student debt balance (for those with student debt) was $48,703.

Here is a quick look at the top five states by average student debt balance.

| State | Percent with student loans | Average Balance for those with student loans | Average monthly payment |

|---|---|---|---|

| District of Columbia | 34 | $71,987 | $203 |

| Georgia | 29 | $59,907 | $183 |

| Mississippi | 28 | $55,347 | $145 |

| Alaska | 22 | $54,555 | $104 |

| Maryland | 31 | $54,495 | $142 |

The statistics are based on all debt relief seekers with a student loan balance over $0.

Student debt is an important part of many households' financial picture. When you examine your finances, consider your total debt and your monthly payments.

Support for a Brighter Future

No matter your age, FICO score, or debt level, seeking debt relief can provide the support you need. Take control of your financial future by taking the first step today.

Show source