What is Budget Billing?

UpdatedApr 15, 2025

- Budget billing is an option many utilities offer for paying monthly bills.

- Budget billing protects you from sudden spikes in your bill that can make budgeting difficult.

- Utility customers make a set payment year-round, paying more than they would in low-usage months, and less than they would in high-usage months.

Table of Contents

Have you noticed extreme fluctuations in your utilities bill lately? Whether your bill has gone down due to a natural disasters like the California wildfires and tropical storms on the Eastern Seaboard, or up because you are working and learning from home, the past several months have probably affected your utility costs.

While unpredictability can make managing your money even harder than usual, there’s a program offered by many utility providers known as “budget billing” that could help.

With budget billing, you pay the same amount on your utility bill each month. This could make it easier to manage the ups and downs of your bill and to avoid the overdraft fees, late charges, and other financial surprises that can happen when you have a tight budget and sudden changes to an ongoing monthly expense. To help you understand more about budget billing, we’ll look at:

Specifics of the budget billing programs offered by many utility companies, including how the cost is calculated.

The pros and cons of budget billing program, such as fees, refund policies, and what happens if a customer uses more energy than planned.

What is budget billing?

Budget billing occurs when your utility company allows you to pay a set amount each month for a particular utility. It can be a good way to keep your utility bill predictable throughout the year so you can budget with more ease.

If you enroll in a budget billing program, instead of having higher bills during high usage months and lower bills during low usage months, you’ll pay the same every month, no matter how much or how little you use your utilities.

Every program is different, but basically, the process works like this: To calculate your monthly fee, your provider will consider how much money you spent on your utilities during a previous time period. Then, they may use a certain percentage to calculate inflation and add it to this number. The total number divided by 12 months will equal your rate. The rate may be adjusted if your actual use changes significantly.

While there are many companies that currently offer budget billing, here’s a look at a few of the bigger ones.

PG&E: To be eligible for budget billing with PG&E, you must have a solid track record of paying your bills in full and on-time. You’ll need to apply to be considered for this program.

Duke Energy: You may be approved for budget billing with Duke Energy if you have a residential account, a good credit history, and no past due balances.

Dominion Energy: If you’ve been a customer at the same location for more than a year, you can enroll in Dominion Energy’s budget billing

4 things to do before you use budget billing

While it may be tempting to call up your utility provider and enroll in their budget billing program right away, there are a few things you should consider first.

1. Calculate the fees: Most companies will charge you a monthly fee, typically known as an administration fee, to participate in budget billing. Make sure you know exactly how much it is and factor it into your budget.

2. Read the refund policy: Sometimes you may use your utility less than planned. Find out if the company will refund your money if this occurs.

3. Review the contract closely: Don’t sign on the dotted line until you read the contract and understand everything it says. The contract should clearly outline the following:

Your monthly rate

Applicable fees

The refund policy

How long your contract will last

What happens if you relocate

4. Understand what happens if you use more energy than planned: This is a real possibility, especially this year. If you use more energy than planned, the company may adjust the rate, or they may bill you at the end of the year.

Other ways to save money on your utility bills

If after reviewing the pros and cons, you determine that budget billing isn’t for you, there are other ways to lower your utility costs. Here are several suggestions.

Switch out your light bulbs

Even though LED light bulbs are more expensive than traditional light bulbs, they use 70% to 90% less energy and last much longer. The biggest variety of LED light bulbs are available online and at local hardware or home improvement stores.

Install a programmable thermostat

With a programmable thermostat in your home, you’ll be able to set the temperature based on your schedule. If you leave home, you can easily turn it down a few degrees. Believe it or not, you can save as much as 10% per year on heating and cooling costs if you turn your thermostat back 7-10º F for 8 hours per day from its typical setting.

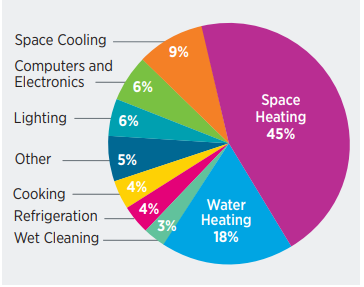

As the chart shows, heating comprises the major portion of most utility bills, so this can result in noticeable savings. Popular options for smart thermostats include the Nest Learning Thermostat and the Ecobee SmartThermostat.

Change your filters regularly

It’s important to change the filters on your air conditioner on a regular basis. If they become clogged with dust, dirt, pet hair, or other substances, your unit will have to work harder, and therefore increase your bill. Try to change the filters in your air conditioning system every few months.

Unplug

If you look around your home, there are probably appliances and devices that are plugged in even though you’re not currently using them. By simply unplugging your microwave, coffee maker, laptop, and hairdryer, you may be able to slash your utility bill by a few hundred dollars per year.

Other ways to manage your money better

If you’d like to manage not just your utility bills, but your debt and other expenses to set yourself up for a healthy financial future, our simple-to-follow guide can help. It’s packed with useful information that will help you succeed. Get started today by downloading the How to Manage Debt guide.

Learn More

What is Zero-Based Budgeting? (Freedom Debt Relief)

What’s Your Financial Next Normal? (Freedom Debt Relief)

Would a Payroll Tax Cut Help You? (Freedom Debt Relief)

Tips on Saving Money and Energy at Home (Energy.gov)

Debt relief by the numbers

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during November 2024. This data reveals the diversity of individuals seeking help and provides insights into some of their key characteristics.

Debt relief seekers: A quick look at credit cards and FICO scores

Credit card usage varies significantly across different age groups, reflecting diverse financial needs and habits.

In November 2024, the average FICO score for people seeking debt relief programs was 586.

Here's a snapshot by age group among debt relief seekers:

| Age group | Average FICO 9 credit score | Average Credit Utilization |

|---|---|---|

| 18-25 | 570 | 89% |

| 26-35 | 579 | 83% |

| 35-50 | 581 | 81% |

| 51-65 | 587 | 77% |

| Over 65 | 607 | 70% |

| All | 586 | 79% |

Use this data to evaluate your own credit habits, set financial goals, and ensure a balanced approach to managing credit throughout your life.

Home-secured debt – average debt by selected states

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) (using 2022 data) the average home-secured debt for those with a balance was $212,498. The percentage of families with mortgage debt was 42%.

In November 2024, 25% of the debt relief seekers had a mortgage. The average mortgage debt was $236504, and the average monthly payment was $1882.

Here is a quick look at the top five states by average mortgage balance.

| State | % with a mortgage balance | Average mortgage balance | Average monthly payment | |

|---|---|---|---|---|

| California | 20 | $391,113 | $2,710 | |

| District of Columbia | 17 | $339,911 | $2,330 | |

| Utah | 31 | $316,936 | $2,094 | |

| Nevada | 25 | $306,258 | $2,082 | |

| Massachusetts | 28 | $297,524 | $2,290 |

The statistics are based on all debt relief seekers with a mortgage loan balance over $0.

Housing is an important part of a household's expenses. Remember to consider all your debts when looking for a way to get debt relief.

Support for a Brighter Future

No matter your age, FICO score, or debt level, seeking debt relief can provide the support you need. Take control of your financial future by taking the first step today.

Show source