What You Should Know About Mortgage Discrimination

BySteve Tanner

UpdatedNov 29, 2025

- Mortgage discrimination means being treated differently for reasons like race, age or gender when applying for a home loan.

- Avoid mortgage discrimination by getting multiple quotes for mortgage lenders when you shop for a home loan.

- If you believe mortgage discrimination has occurred, file a complaint.

Table of Contents

As our contribution to the ongoing discussion America is having around racial inequality, here is another post in our Financial Discrimination, Access, and Equality series. We will continue to share information about how to recognize and help combat financial discrimination, so please come back to read future posts.

Mortgage lenders should decide who they will lend to on the basis of credit history, FICO score, income, and size of down payment. These objective measures of creditworthiness are important risk indicators, as lenders need assurances that you can make your payments on time, and ultimately pay back the loan. Characteristics such as national origin, immigration status, race, skin color, or religion tell lenders absolutely nothing about your creditworthiness. And yet, decisions have been (and continue to be) made on that basis, and the legacy of redlining and other discriminatory practices casts a long shadow over many prospective borrowers.

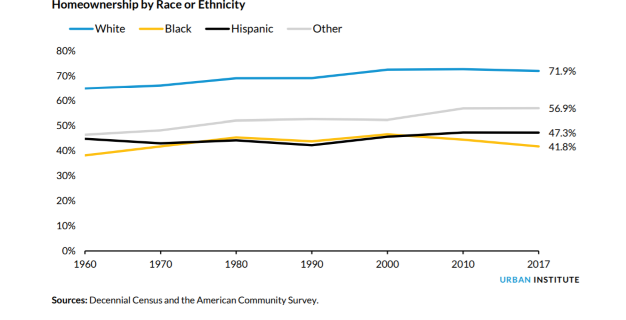

Mortgage discrimination has restricted access to the American dream by African Americans and other marginalized people for generations – and it continues. In fact, the home ownership gap between black and white communities in the United States actually grew to its widest disparity in 50 years in 2019, according to research by the Urban Institute.

This gap highlights the ongoing challenge for African Americans to have equal access to mortgages even though there are significant federal and state laws designed to eliminate mortgage discrimination. It also affects more than just home ownership, limiting access to a broad range of opportunities that you might not immediately consider. For example, if wealth is not passed via home ownership, it is harder for following generations to move to more areas with better jobs, access loans to start a business, or gain access to more education.

This type of discrimination has held back certain Americans for generations, so it’s not something that will magically be solved overnight. However, the following information could help you assert your rights, gain access to equitable loans (including alternatives to traditional banks), and forge ahead with your pursuit of the American dream. First, we’ll briefly discuss the history of housing and mortgage discrimination to provide some context for where we are today.

A look back at the history of redlining and mortgage discrimination

Beginning in 1933, the federal government instituted a plan to remedy a housing shortage by dividing housing stock into categories using color-coded maps. African American communities and other neighborhoods deemed “undesirable” were colored red in these maps, giving rise to the term “redlining.”

The Federal Housing Administration (FHA) enforced a policy of segregation by refusing to insure mortgages for any homes in the redlined areas. The FHA’s Underwriting Manual explicitly stated that, “incompatible racial groups should not be permitted to live in the same communities.” This manual also suggested building concrete walls and highways to separate communities by race.

This policy of housing and mortgage discrimination was so blatant that the FHA even subsidized builders to produce entire “white only” subdivisions in the suburbs. The practice also discriminated against immigrants from Asia and southern Europe, Catholics, Latinos, Jews, and virtually anyone who wasn’t of Northern or Western European descent.

Redlining persisted as official policy until passage of the Fair Housing Act of 1968 (FHA), which states that it is “unlawful to discriminate in the terms, conditions, or privileges of sale of a dwelling because of race or national origin.” This does not mean, however, that this type of discrimination ceased to exist.

The broad implications of mortgage discrimination

If you’re denied a home loan, you and your future generations could be missing out on much more than just a home. When you are a homeowner, you are building your own wealth instead of helping your landlord build theirs. Owning a home also provides intangibles such as being connected to your community and the stability of knowing that you won’t have to suddenly move, unless you decide to.

Families that have this stability, are building wealth, and have options for leveraging their mortgage, can better provide for their children, who then have a better start to their adult lives. For these reasons and more, access to home ownership can have a major impact that goes well beyond a roof over your head. The multi-generational ripple effects of home loan access or lack of access, can’t be overstated.

Home loans are often referred to as a form of “good debt,” since they can open doors to many other opportunities. A home mortgage can give you options and improve your overall financial health in several ways, such as:

Your mortgage payments build equity that you may access later.

Homes often appreciate in value, especially if they’re well maintained and improved.

Home ownership can improve your creditworthiness and provide access to other types of credit like student, auto or business loans.

You can refinance your home, take out a home equity loan, or home equity line of credit (HELOC) to pay for college or other big expenses.

If you own your home, you can pass that asset down to the next generation.

How to get access to home loans

Research compiled by Zillow paints an unsettling picture regarding access to home loans by creditworthy minority applicants, with data showing denial of pre-approval at double the rate of their white counterparts. While many of the following suggestions for accessing home loans are universal, they’re particularly important for people of color and other traditionally underserved communities.

Take care of your credit. Anyone looking to take out a mortgage will need to have good credit that’s reflected in their credit report. Even simple things like missing a credit card payment once or twice can hurt your credit score.

Seek out minority-owned lenders. Find mortgage lenders who are either minority-owned or who have a strong track record of lending (and lending equitably) to minorities. A good way to do this is to check the bank’s track record of lending in the community, which is measured by their Community Reinvestment Act (CRA) rating.

Be realistic about your budget. White homebuyers are more likely to have an inheritance or other generational windfall to help with the down payment. Check your finances and do research to determine your budget for a new home, as a down-payment is often the biggest challenge for those without inter-generational wealth to fall back on.

Take care of financing early. By getting pre-approved for a loan, you’ll be able to make a competitive offer more quickly once you find the home you want.

Consider alternative lenders. There is an abundance of non-bank mortgage lenders, many operating entirely online, that could be less discriminatory because they make decisions based on computer algorithms (the algorithms themselves may have bias, but the conscious bias can be eliminated this way).

Talk to 3 lenders, or more: Comparing terms is not only a good way to ensure you are being treated fairly, it is a good way to ensure you get the best terms. Shop around and let lenders compete. Do your work within a fairly tight window though, as numerous hard credit pulls may affect your credit score.

Whichever path you take to finance your home, make sure you do your homework, shop around, and trust your instincts. Understanding that mortgage discrimination still exists shouldn’t deter you, but you’ll want to be vigilant.

If you need debt relief in Franklin, VA (or anywhere else in the country), explore your options. The first step is the most important one—find out more today.

What to do if your access is unfairly denied

There may be other legitimate reasons for a denial, such as a low appraisal. But if your application was denied and you suspect discrimination, the Federal Trade Commission suggests the following measures:

Contact the lender. It’s possible they may reconsider if confronted.

Contact your state Attorney General’s office. They may have violated a state equal credit opportunity statute.

Sue the lender in federal court. You may recover actual damages and legal fees if you prevail. Consider joining or starting a class action lawsuit if you suspect a pattern of discrimination.

File a complaint with the appropriate agency. Contact the Consumer Financial Protection Bureau if you suspect a violation of the Equal Credit Opportunity Act, and the Department of Housing and Urban Development if you suspect an FHA violation.

Don’t be afraid to take any necessary legal action just because you think you can’t afford it. There are lawyers committed to pro bono practice and legal aid groups who can assist.

Protect your right to access the American dream

While we don’t have the solutions to the mortgage discrimination problem in our country, Freedom Debt Relief is dedicated to providing information about this and other challenges to help you understand your finances and your rights so you can better protect yourself and your financial future. Please visit our blogs for additional updates with this series and other topics.

Learn more

What You Should Know about Credit Discrimination (Freedom Debt Relief)

What protections do I have against credit discrimination? (Consumer Financial Protection Bureau)

Shopping for a Mortgage (FTC)

Five Home Buying Mistakes to Avoid (Freedom Debt Relief)

Mortgage Discrimination: Don’t Be a Victim (HSH Associates)

A look into the world of debt relief seekers

We looked at a sample of data from Freedom Debt Relief of people seeking the best debt relief company for them during October 2025. This data highlights the wide range of individuals turning to debt relief.

Debt relief seekers: A quick look at credit cards and FICO scores

Credit card usage varies significantly across different age groups, reflecting diverse financial needs and habits.

In October 2025, the average FICO score for people seeking debt relief programs was 596.

Here's a snapshot by age group among debt relief seekers:

| Age group | Average FICO 9 credit score | Average Credit Utilization |

|---|---|---|

| 18-25 | 576 | 83% |

| 26-35 | 586 | 78% |

| 35-50 | 590 | 76% |

| 51-65 | 596 | 74% |

| Over 65 | 612 | 67% |

| All | 596 | 74% |

Use this data to evaluate your own credit habits, set financial goals, and ensure a balanced approach to managing credit throughout your life.

Student loan debt – average debt by selected states.

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) the average student debt for those with a balance was $46,980. The percentage of families with student debt was 22%. (Note: It used 2022 data).

Student loan debt among those seeking debt relief is prevalent. In October 2025, 27% of the debt relief seekers had student debt. The average student debt balance (for those with student debt) was $48,703.

Here is a quick look at the top five states by average student debt balance.

| State | Percent with student loans | Average Balance for those with student loans | Average monthly payment |

|---|---|---|---|

| District of Columbia | 34 | $71,987 | $203 |

| Georgia | 29 | $59,907 | $183 |

| Mississippi | 28 | $55,347 | $145 |

| Alaska | 22 | $54,555 | $104 |

| Maryland | 31 | $54,495 | $142 |

The statistics are based on all debt relief seekers with a student loan balance over $0.

Student debt is an important part of many households' financial picture. When you examine your finances, consider your total debt and your monthly payments.

Support for a Brighter Future

No matter your age, FICO score, or debt level, seeking debt relief can provide the support you need. Take control of your financial future by taking the first step today.

Show source

Author Information

Written by

Steve Tanner

Steve Tanner is a veteran writer and editor with experience covering topics from law, to business, technology, and finance. He started his career as a business and technology reporter in Silicon Valley and helped lead the direction of several publications, both print and online. His work has been published in Red Herring, San Jose Business Journal, SFGate.com, and FindLaw.com, among others.