What Is Household Wealth?

UpdatedApr 25, 2025

- Household wealth equals your total assets minus your total liabilities.

- Household wealth is also called “household net worth.”

- Home equity and retirement accounts are the largest sources of household wealth for most Americans.

Table of Contents

- Household Wealth in 2022

- How is household wealth calculated?

- Why is net household wealth important?

- Household Wealth Starter: An Emergency Fund

- Household Wealth Builder: Home Equity

- Long-Term Household Wealth Creation: Retirement Savings

- Debt Drains Your Household Wealth

- Key Measure of Financial Health: Debt-to-Income Ratio

- Job 1 For Building Net Household Wealth: Get Debt Under Control

Household wealth is the value of your possessions after subtracting out your loan balances. In other words, household wealth is what you own minus what you owe. While your income has a lot to do with making ends meet, household wealth measures how well you’re getting ahead over time.

Household Wealth in 2022

US household wealth reached a record high in 2021. Sounds great, but the bad news is that inflation in 2021 was the highest in almost 40 years.

So, while people were saving money to get ahead, inflation was eating up some of those gains. Things have only gotten worse in early 2022, as investments have stumbled while inflation and rising interest rates are taking bigger bites out of household wealth.

Net household wealth is the ultimate measure of whether you are getting ahead or falling behind financially. This year’s economic challenges make it more important to do what you can to build household wealth in 2022.

This article will look at questions like what is household wealth, how is household wealth calculated, and why household wealth is crucial for your future.

Beyond that, this article will also outline some steps you can take to build household wealth this year.

How is household wealth calculated?

The best way to explain household wealth is to describe how it’s calculated.

Make a mental list of everything you own. This list may include bank accounts, retirement accounts, your home, cars, and even personal possessions. Those are your assets.

Now think of everything you owe. That list may include a mortgage, student loans, auto financing, or credit card debt. Those are your liabilities.

You calculate household wealth as the current value of your assets minus your liabilities. It’s sometimes known as net household wealth because it’s the value of what you own net of any amounts you owe.

Why is net household wealth important?

Net household wealth is important because it measures how much of a cushion you’ve built up for future use – your financial security.

Financial security isn’t just a matter of how valuable your possessions are. A person may own a $600,000 house, but if it has a $590,000 mortgage, that debt will be a drain on their future wealth.

Somebody who owns a $200,000 house free and clear may not look as wealthy, but that $200,000 in equity contributes more to household wealth than the $10,000 in equity the person with a $600,000 house and $590,000 mortgage has.

Net Household Wealth Reached Record Level in 2021

What kind of year was last year for the net household wealth of Americans?

It was quite a good year, as total household wealth reached a record $150 trillion.

Also, you know the old saying about the rich getting richer? Well, the rich did get richer in 2021, but less wealthy Americans made progress at an even faster pace for once.

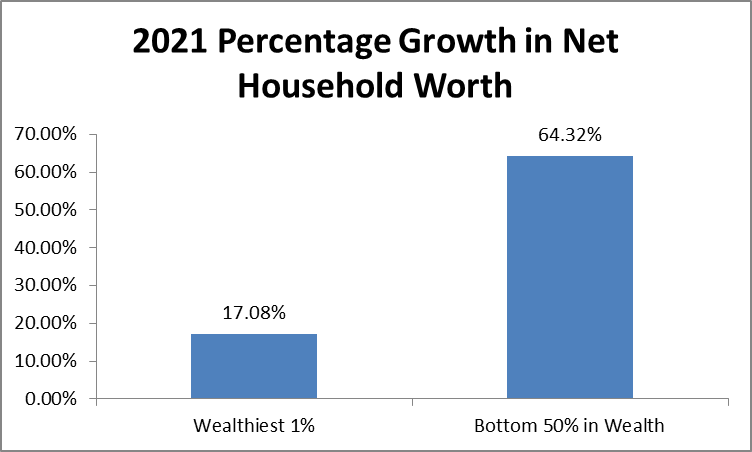

As the chart below shows, the household net worth of the wealthiest 1% of Americans grew by 17.08% last year. Not bad, but the poorest half of US households saw net worth increase by 64.32% in 2021.

Of course, the wealthiest 1% started out far ahead of the bottom 50%, so that lower percentage growth translated to a lot more in dollar terms.

Still, the important thing is that from top to bottom, Americans overall experienced a good year for net worth growth.

Inflation Makes Building Net Household Worth More Important

That growth couldn’t have come at a better time because inflation picked up steam last year. Based on the Bureau of Labor Statistics figures, 2021’s 7.1% inflation rate was the highest in 40 years.

Fast-rising inflation makes building household wealth all the more critical. You need to grow your wealth just to keep pace with inflation. If you stand still, you’ll be losing ground as things you buy get more and more expensive.

Building household wealth will help you continue to be able to afford the things you want and need as prices rise. It will also allow you to get ahead of inflation enough to provide for your future.

Regardless of where you’re starting, you can immediately take steps to increase your net household wealth.

Create an emergency fund to start saving.

Use home equity to build wealth.

Invest in a retirement plan to create long-term wealth.

Household Wealth Starter: An Emergency Fund

An emergency fund is money set aside that you can quickly get at for those financial curveballs life throws at you.

Your emergency may be an unexpected car repair or a medical expense. It could also be a hit to your income, like losing your job.

Experts often suggest setting aside emergency savings to cover three to six months of necessary expenses. Depending on your obligations and how uncertain your situation is, you may even want to save more.

Here are some tips for getting that emergency fund going:

Pay into it like it is a monthly bill. If you only save when it’s convenient, you may never get around to it. Give yourself a monthly goal and treat making that deposit as a must.

Bank your credit card rewards. If you use a cash-back credit card, you can deposit those rewards into your emergency fund. As long as you’re paying your credit card balance off every month, this can be a way of turning spending into saving.

Sell what you don’t need. Turn unused things you’ve purchased into valuable assets by selling them. Have a garage sale or do it online.

Household Wealth Builder: Home Equity

According to the Federal Reserve’s Survey of Consumer Finances, home equity is the most significant part of household wealth for the average American.

Paying down a mortgage every month doesn’t just provide housing. It also builds wealth. Meanwhile, an increase in your home’s value also contributes to home equity and thus to net worth.

Whether you are thinking of buying a house or already own one, here are some tips to help you build home equity:

Shorter mortgage terms build equity faster. Longer mortgages offer lower monthly payments, which can be appealing or even necessary. However, shorter mortgages carry lower interest rates and pay down your principal much faster. It may be more affordable than you think – a 15-year loan pays off your mortgage in half the time of a 30-year loan. But the payment is not twice as high.

Accelerating payments can put more money towards equity. If you can occasionally make extra payments towards your mortgage, it helps you build equity faster and reduces the amount of interest you pay over the life of your mortgage. If you have the opportunity to refinance, switching to a shorter-term mortgage could ramp up your equity building.

Borrowing against equity subtracts from net worth. Because equity in a home is often a person’s largest asset, it is tempting to borrow against it. Home equity can be a cost-effective source of credit. Remember, though, that borrowing against home equity subtracts from your net household wealth. One exception: if you borrow against home equity to pay off higher-interest debt, this consolidation could be part of an effective debt reduction strategy.

Long-Term Household Wealth Creation: Retirement Savings

Another primary source of household wealth is retirement savings accounts. Between tax advantages, possible employer matching contributions, and the benefit of compounding returns over time, retirement savings can be a powerful wealth creation tool.

Regular contributions to retirement savings are not just a great way to build wealth now, but it is key to providing for a time when you are no longer bringing home a paycheck.

Here are some tips for using retirement savings effectively to build wealth:

Start early. When you’ve just started your career, you might think that retirement is too far away to worry about it. On the contrary, those early years are the best time to start saving for retirement. Because of compounding, the sooner money goes into your retirement plan, the bigger its effect on your long-term wealth.

Increase contributions as your career progresses. When promotions, raises, or job changes increase your income, up your retirement contributions. Enjoy part of those raises now and put some towards future enjoyment.

Take full advantage of retirement benefits. Retirement plans have tax advantages that magnify the impact of your savings. Some have employer matching contributions that add to the money you put in. If you don’t take full advantage of these benefits, you’re leaving money on the table.

Debt Drains Your Household Wealth

Borrowing is sometimes necessary, but keep it to a minimum because it subtracts from household wealth in two ways.

Every time you borrow, you immediately subtract from your net household wealth. Then, paying interest on that debt reduces the amount of money available for savings.

In terms of household wealth, the two most harmful types of borrowing are the following:

Loans that are not offset by an asset. Taking out a mortgage that allows you to buy a house adds both an asset and a debt. That’s a wash, and then you can work on building equity in the home by paying down the debt. However, a loan for something temporary like a vacation just adds debt without an offsetting asset.

High-interest debt. Carrying a credit card balance is a prime example of high-interest debt. The more you pay in interest, the more it drains your household wealth.

Key Measure of Financial Health: Debt-to-Income Ratio

Though it isn’t directly a part of household wealth, your debt-to-income ratio helps you track whether your borrowing is under control.

Debt-to-income ratio is simply the amount of money you spend every month on debt payments divided by your before-tax monthly income.

If that ratio gets above 30%, you’ll find you have little money after that and living expenses to put towards savings.

While your debt-to-income ratio isn’t part of your net worth today, it’s a key measure of your ability to build wealth in the future. However, debt-to-income just measures monthly payments, not total debt. You can easily take on too much debt if the minimum payments are kept low – that’s how credit card companies keep people in debt for decades.

Job 1 For Building Net Household Wealth: Get Debt Under Control

You can’t create wealth overnight, but you can take steps right away that position you to start building wealth.

The first step is to get debt under control. Get on a path towards paying down all debt eventually and getting rid of high-interest debt as quickly as possible.

If you feel overwhelmed by debt, consider getting advice from a debt relief professional. This advisor can explain available options and help you formulate a plan to pay off your debts and start building wealth.

Debt relief stats and trends

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during November 2024. The data uncovers various trends and statistics about people seeking debt help.

Credit Card Usage by Age Group

No matter your age, navigating debt can be daunting. These insights into the credit profiles of debt relief seekers shed light on common financial struggles and paths to recovery.

Here's a snapshot of credit behaviors for November 2024 by age groups among debt relief seekers:

| Age group | Number of open credit cards | Average (total) Balance | Average monthly payment |

|---|---|---|---|

| 18-25 | 3 | $9,011 | $282 |

| 26-35 | 5 | $12,647 | $390 |

| 35-50 | 6 | $16,172 | $431 |

| 51-65 | 8 | $16,725 | $529 |

| Over 65 | 8 | $17,047 | $499 |

| All | 7 | $15,142 | $424 |

Whether you're starting your financial journey or planning for retirement, these insights can empower you to make informed decisions and work towards a more secure financial future

Personal loan balances – average debt by selected states

Personal loans are one type of installment loans. Generally you borrow at a fixed rate with a fixed monthly payment.

In November 2024, 44% of the debt relief seekers had a personal loan. The average personal loan was $10,718, and the average monthly payment was $362.

Here's a quick look at the top five states by average personal loan balance.

| State | % with personal loan | Avg personal loan balance | Average personal loan original amount | Avg personal loan monthly payment |

|---|---|---|---|---|

| Massachusetts | 42% | $14,653 | $21,431 | $474 |

| Connecticut | 44% | $13,546 | $21,163 | $475 |

| New York | 37% | $13,499 | $20,464 | $447 |

| New Hampshire | 49% | $13,206 | $18,625 | $410 |

| Minnesota | 44% | $12,944 | $18,836 | $470 |

Personal loans are an important financial tool. You can use them for debt consolidation. You can also use them to make large purchases, do home improvements, or for other purposes.

Regain Financial Freedom

Seeking debt relief can be the first step toward financial freedom. Are you struggling with debt? Explore options for debt relief to regain control of your finances. It doesn't matter how old you are or what your FICO score or credit utilization is. Take the first step towards a brighter financial future today.

Show source